Close

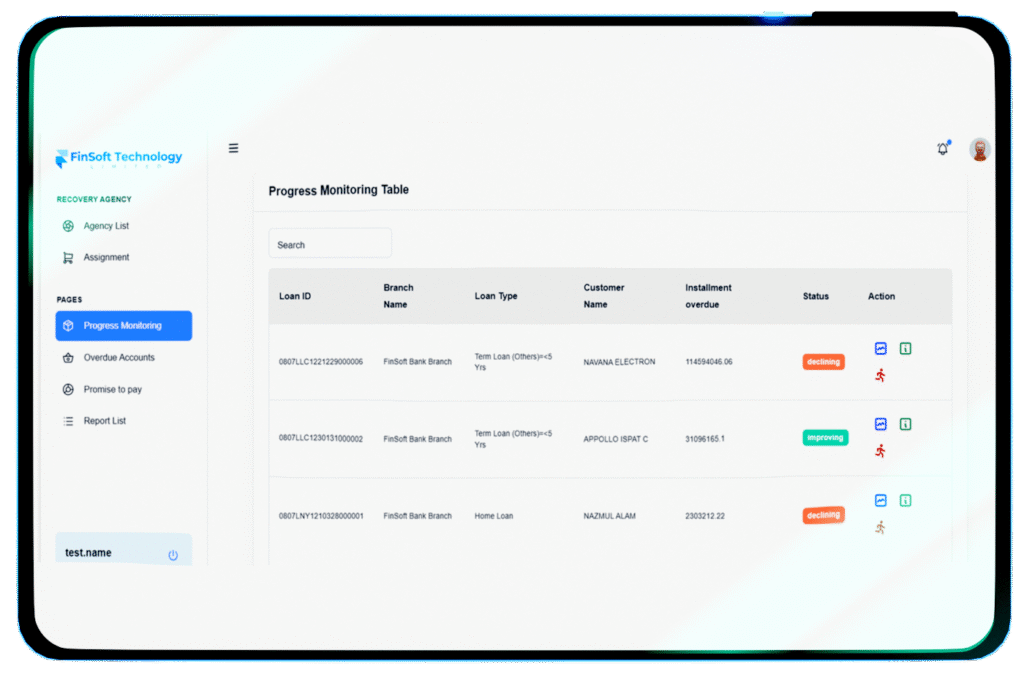

The FinSoft Recovery Agency Module transforms recovery management. Track loan repayments, optimize resource allocation, and enhance borrowers’ communication- all in one intuitive platform. With powerful reporting tools and streamlined processes, drive faster and more efficient recovery outcomes.

Revolutionize your financial journey with us!