Close

Manual checks, reporting chaos, and missed deadlines are a thing of the past.

FinSoft CIB Compliance Suite automates the entire CIB reporting lifecycle, reducing errors and ensuring full compliance with Bangladesh Bank’s guidelines.

Seamlessly integrated with Core Banking, it offers real-time validation, error detection, and RPA-powered submissions.

Stay ahead of Bangladesh Bank’s evolving directives with a solution built for accuracy, speed, and compliance.

Effortlessly generate and submit daily (T+1), weekly, and monthly reports—on time, every time.

Real-time data extraction from your Core Banking System ensures consistency and accuracy across every report.

Automate report uploads with Robotic Process Automation for zero manual effort and full compliance.

Leverage advanced AI and OCR to scan, analyze, and interpret CIB reports with unmatched precision

Control user roles with audit-ready workflows for data entry, verification, and final approval.

Generate BB-compliant reports in the exact formats required for submission.

Catch and correct issues before submission with intelligent validation rules and predictive analytics.

Enhance borrower communication with our multichannel notification system.

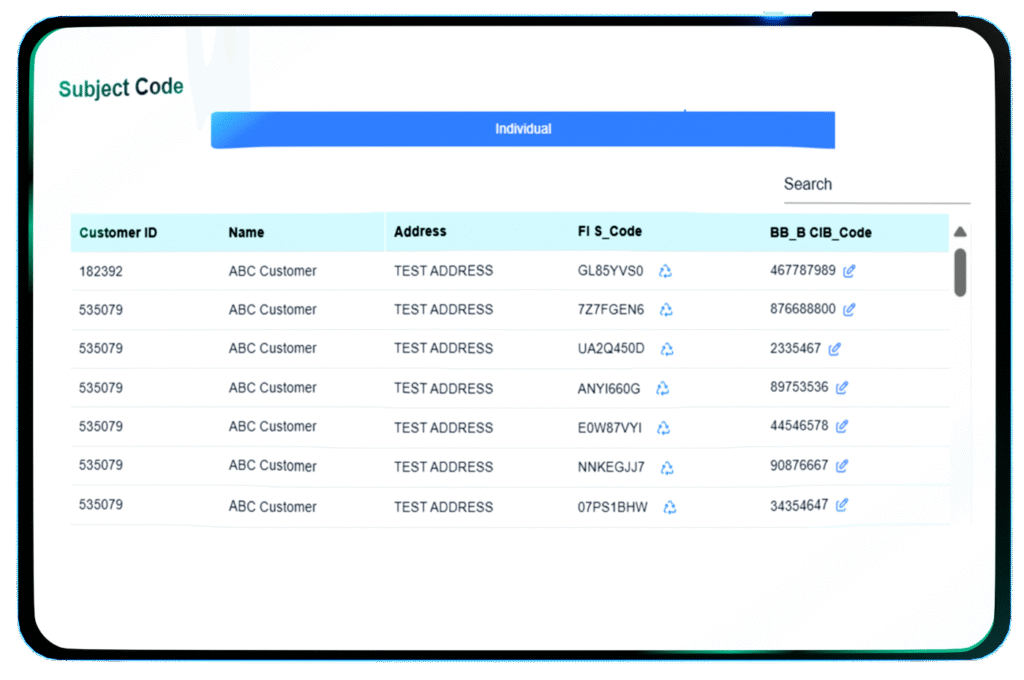

Auto-generate and manage Subject and Contract Codes, including roles like borrower, co-borrower, and guarantor.

Automatically zero out balances, flag terminated accounts, and generate related reports.

Monitor pending, submitted, and upcoming reports with full audit logs and process visibility.

Revolutionize your financial journey with us!